Murphy Bed Design Ideas for Small and Modern Homes

November 5, 2025

Top Pocket Sliding Doors to Maximise Compact Interiors

November 5, 2025Buying a property is one of the biggest investments in life.

However, in India, many property disputes arise because buyers skip the most important step of verifying the title deed. A clean and valid title deed is proof that the seller is the legal owner and has the right to sell the property. Without it, you risk falling victim to fraud, facing court battles, or losing your hard-earned money.

In this blog, we will explore what a title deed is, how to verify title deed in India, the key documents needed for verification, and the red flags to watch out for.

Let’s get started!

Also read: Top 20 things to check before buying a flat or old home.

Table of contents

- What Is A Title Deed?

- Step-by-Step Process To Verify Title Deed In India

- Step 1: Collect the original title deed

- Step 2: Check the chain of ownership

- Step 3: Verify the registration details

- Step 4: Confirm stamp duty payment

- Step 5: Obtain the encumbrance certificate (EC)

- Step 6: Check land records, revenue and mutation online

- Step 7: Verify land use permissions

- Step 8: Confirm layout and building approvals

- Step 9: Search for pending litigation or dues

- Step 10: Check for government acquisition notices

- Step 11: Hire a property lawyer for final verification

- What Are The Red Flags To Watch Out For While Verifying A Title Deed?

- FAQs

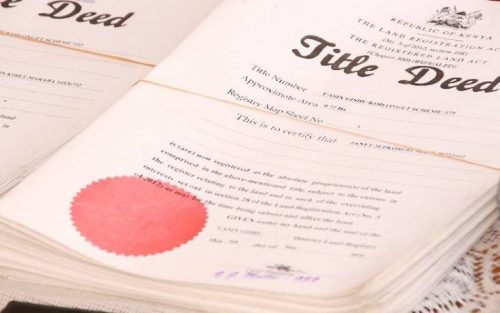

What Is A Title Deed?

A title deed is a legal document that proves ownership of a property. It shows who owns the property, how they acquired it (sale, inheritance, gift, or partition), and whether they can sell it further.

Why Verify Title Deed In India?

Verifying a title deed is not just about paperwork; it is your legal protection. Here is why it matters,

- Confirms the seller’s rightful ownership

- Reveals loans, mortgages, or any disputes related to the property

- Ensures the property can be legally transferred to you

- Speeds up the loan approvals and insurance from banks

- Protects you from fraud, scams, and financial losses

What Are The Key Documents Needed To Verify Title Deed In India?

The following are the critical documents required to verify the title deed.

- Sale deed

- Mother deed

- Encumbrance Certificate (EC)

- Khata/ Patta/ Mutation certificate

- Property tax receipts

- Approved building plan and layout

- Occupancy Certificate (OC) or Completion Certificate (CC)

- Possession certificate

- Records of Rights (RoR)/ Jamabandi/ RTC

- No Objection Certificate (NOCs)

- Power of Attorney (if applicable)

Let’s see how to check property documents in India.

Step-by-Step Process To Verify Title Deed In India

Step 1: Collect the original title deed

First things first, ask for the original title deed and not just the photocopy (a missing original is a warning sign). Along with it, request supporting papers like earlier sale deeds, gift deeds, partition deeds, or inheritance documents.

Step 2: Check the chain of ownership

The title deed should have a clear chain of previous owners. Trace all transfers for the past 30 years- the sale deeds, inheritance, partition, or gift deeds.

Every link must be documented. If any link is missing or vague, there is a chance that someone may claim rights later, or disputes may arise. Details such as the owner’s name, survey number, plot size, and property boundaries must remain consistent across all the documents.

Step 3: Verify the registration details

Confirm that the deed is registered in the correct Sub-Registrar’s Office for the property’s location. Only a registered title deed has legal validity. Unregistered or poorly documented deeds are not enough to prove full ownership and can be challenged in the courts.

Cross-checking the details, like registration number, date and official seal, prevents issues within the jurisdiction.

Step 4: Confirm stamp duty payment

Ensure the right stamp duty was paid at the time of registration. Improperly stamped documents may not be valid in court.

Step 5: Obtain the encumbrance certificate (EC)

An encumbrance certificate is proof that the property is free from financial or legal liabilities. It shows whether the property has outstanding loans, mortgages, pending legal disputes or attachments by courts and previous sales or claims.

While getting the certificate, request it for at least the last 13 to 30 years. A clean EC is a strong indicator of a marketable title.

Also read: A complete guide to preparing land for construction.

Step 6: Check land records, revenue and mutation online

Most states in India now provide digital access to land records under the Digital India Land Records Modernization Programme (DILRMP). When you search for the property on your state’s portal, check the following.

- Mutation records show if the ownership has been updated after past sales or inheritance in municipal or revenue office (government) records.

- The survey number, area, khata number, property ID, and classification match the deed and actual property.

- Record of Rights (RoR) or 7/12 extract, to confirm the legal owner

Compare these with the seller’s documents for accuracy.

Step 7: Verify land use permissions

Check if the land is approved for residential, commercial, or agricultural use. For example, agricultural land must be legally converted before construction.

Step 8: Confirm layout and building approvals

If buying flats in a housing project, check if the builder has building plan approval, occupancy certificate, completion certificate and conversion certificate (if agricultural land was converted) from the municipal authorities or local development. Illegal or unauthorised projects can face demolition.

Step 9: Search for pending litigation or dues

Even if the paperwork looks correct, the property could be under litigation. Do a litigation search in local civil courts or online databases to confirm the property is not stuck in ongoing disputes.

Check that all municipal taxes, society dues, and utility bills are paid up to date. Outstanding dues could become your responsibility after purchase.

Step 10: Check for government acquisition notices

Some properties may be marked for road expansion, metro rail, or other public projects. Ensure your property is not listed for acquisition.

Step 11: Hire a property lawyer for final verification

A qualified property lawyer can review all documents, detect forged papers, highlight risks that you may miss and ensure the deed is legally sound. This step adds the utmost layer of safety.

You can also hire a surveyor to confirm the land boundaries and measurements. Before granting a loan, the bank’s legal team also performs independent verification.

These are the step-by-step processes to verify title deed in India.

What Are The Red Flags To Watch Out For While Verifying A Title Deed?

When it comes to property title verification, buyers should be cautious of certain warning signs, like

- Missing or inconsistent documents

- Conflicting ownership records

- Unverified seller

- Absence of official registration

- No encumbrance certificate

- Outstanding loans or mortgages

- Unusual payment history

- Pending court cases

- Unapproved layouts or constructions

- Poor quality or forged documents

If you notice any red flags in land title verification India, hold the purchase process and get professional legal assistance before making any financial commitments.

Also read: Smart upgrades that instantly increase your property value.

While ensuring your property is legally sound, it is also wise to consider quality home upgrades that add long-term value. GreenFortune’s uPVC windows and doors are highly durable, energy-efficient, easy to maintain, and a smart investment alongside your verified property.

FAQs

1) How long does the title verification process take?

Title verification can take anywhere from a few days to a few weeks, depending on document availability, online access, local office procedures, and whether professional legal help is involved.

2) Is title verification mandatory for all types of property in India?

Yes, whether buying land, an apartment, or a commercial property, title verification is essential to ensure ownership, clear legal status, and protection from disputes or fraud.

3) What happens if a title deed is forged or tampered with?

A forged deed is legally void. Buyers may face litigation, financial loss, or eviction. Legal verification and professional review prevent such risks before property transfer.

verify title deed in India